Personal Finance in Practice: Costs and Benefits Incentives

In personal finance, the theories of cost and benefit analysis help to inform the foundations of proper budget planning. These concepts might seem difficult to grasp and understand on the face of it. But the reality is that most of us already have a strong intuitive understanding of how these ideas work in our daily lives.

Here, we will look at some of the ways costs and benefits can be tracked using budget tracker tools and positively impact the bottom line so that households can maximize spending efficiency in daily spending routines.

Weighing the Positives and the Negatives

Right from the beginning, consumers must start with rational expectations so that rational spending choices can actually be made. In any set of circumstances, consumers are looking to make decisions that create the greatest benefits with the lowest costs. At the very least, the goal of any budget planning exercise should be to provide more in benefits than it does in costs.

As an example, let’s imagine we are considering opening a business that produces bicycles. If local demand for bicycles is rising, we can reasonably expect more businesses to gravitate toward the industry and hire more employed with relevant experience in the field. But these practices will only be conducted if businesses see the proper justification for the added expenses and investment.

If bicycle prices and sales volume are predicted to outweigh the added payroll costs and investment in materials, we can expect businesses to spend the extra money.

If this is not the case, a rational budget planner would look for other ways of spending the available funds. The same logic applies to household budgeting: Benefits must always outweigh the costs in order to justify the additional expenditures.

The Rising Costs of College

To put things into more personal terms, we can look at a problem that many families and households face each year: the rising costs of college tuition.

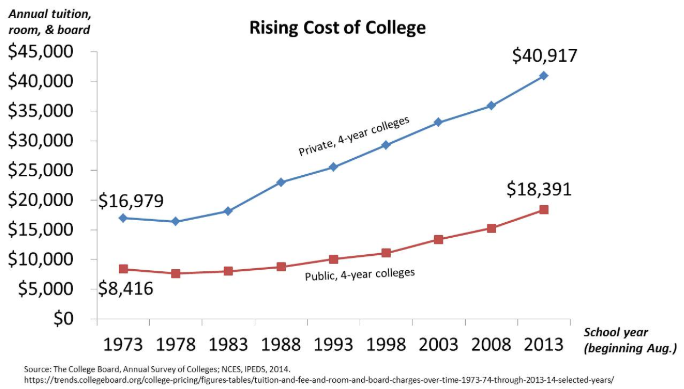

Here, we can see that over the over the 40-year period between 1973 and 2013, the costs of college tuition more than doubled. Upward movements in cost were seen in both public and private institutions, so the troublesome trends here are relatively clear.

This type of extreme price inflation is not common for the market as a whole, and these are the types of problematic financial scenarios that can put the most financial strain on a family (especially younger families). But forgoing the opportunity to complete a degree in higher education can have its own consequences in leading to reduced competitiveness in the jobs market and lower prospects for career earnings figures.

As we can see, the idea of cost/benefit analysis can extend far beyond simple financial questions. These are life issues that can significantly impact the lives of families and individuals. For these reasons, it is always important to weigh the potential positives and negatives that will accompany any spending decision.

Making Budget Lists: Separate the Pros and Cons

In most cases, people will behave in a rational fashion. But the ability to make prudent spending choices also depends on the data we make available to inform those decisions. Our “internal accountant” can be hamstrung if we do not assess all of the factors that could potentially lead to bad budgeting decisions.

Making a budgeting list can be particularly helpful here in allowing us to compare the potential positives (benefits) and the potential negatives (costs).

Unfortunately, it can sometimes be difficult to know which factors represent the “positives” and which factors represent the “negatives.” But the chart above can be helpful in determining some of these distinctions.

As we can see, rising costs tend to diminish the benefits (or incentives) for making a specific purchasing decision. If added costs are not accompanied by rising benefits, it is more likely that the factor belongs on the “negative” side of your budgeting list.

Conversely, rising personal benefits that are not dependant on higher prices paid will likely suggest that the factor in question is actually a positive argument for making that specific spending decision. These studies should always be viewed as a vital consideration any time a large spending decision needs to be made in your household spending budget.